The day-to-day fluctuations of gold rate in Abu Dhabi remain a question for many people. You must stay informed about current gold prices if you fall under the categories of investor or jeweler or customer considering purchase. Numerous elements including worldwide market direction alongside currency rate fluctuations and consumer behavior in the domestic market strongly influence the prices of gold.

The following article provides a thorough evaluation of Abu Dhabi’s gold pricing system for both grams and tolas together with detailed insights about market influencers that will assist your investment choices.

Understanding Gold Pricing in Abu Dhabi

The market quotes gold values using measurements of tolas and grams. The following points show how prices for gold work:

- Per Gram Price – People use this unit for everyday purchases as well as smaller transactions.

- Per Tola Price – This traditional South Asian unit comprises one tola but equals 11.66 grams (1 tola = 11.66 grams). The unit functions during major business deals.

- 22K vs. 24K Gold – 24K is pure gold, while 22K contains a mix of alloys, making it more durable and popular for jewelry.

Factors Influencing Gold Prices in Abu Dhabi

Daily gold rates undergo changes based on several influencing aspects.

1. International Gold Market Trends

The price of gold in Abu Dhabi has close correlations to international gold markets because of several factors which include:

- Supply and demand fluctuations

- Global economic stability

- The Federal Reserve System and other central banks across the world establish interest rates

2. Currency Exchange Rates

The AED-USD exchange rate movements create straight-line impacts on the market prices of gold in Abu Dhabi because gold trades in U.S. dollars.

3. Inflation and Economic Conditions

Gold maintains status as a protection against inflationary trends in the economy. The upward movement of inflation drives investors to seek gold because of its status as a secure financial haven.

4. Local Demand and Supply

- The high demand volume during festive periods and weddings generates increased costs for consumers.

- Local regulations together with import policies have the ability to affect product prices.

Today’s Gold Rate in Abu Dhabi (Updated Daily)

| Gold Type | Price Per Gram (AED) | Price Per Tola (AED) |

|---|---|---|

| 24K Gold | AED 230 | AED 2684 |

| 22K Gold | AED 210 | AED 2450 |

| 21K Gold | AED 195 | AED 2275 |

| 18K Gold | AED 170 | AED 1983 |

Should You Invest in Gold in Abu Dhabi?

Potential investors should evaluate market trends before investing in gold because it is a reliable and profitable asset. Here are key investment strategies:

1. Buy During Dips

The best time to purchase gold for maximizing financial gains comes when prices drop in the market.

2. Consider Gold ETFs or Digital Gold

Potential investors can choose to buy gold ETFs or digital gold products for more convenient trading and better safety levels.

3. Stay Updated on Market Trends

Monitor worldwide gold rates together with economic elements that include inflation levels and interest rates and geopolitical events.

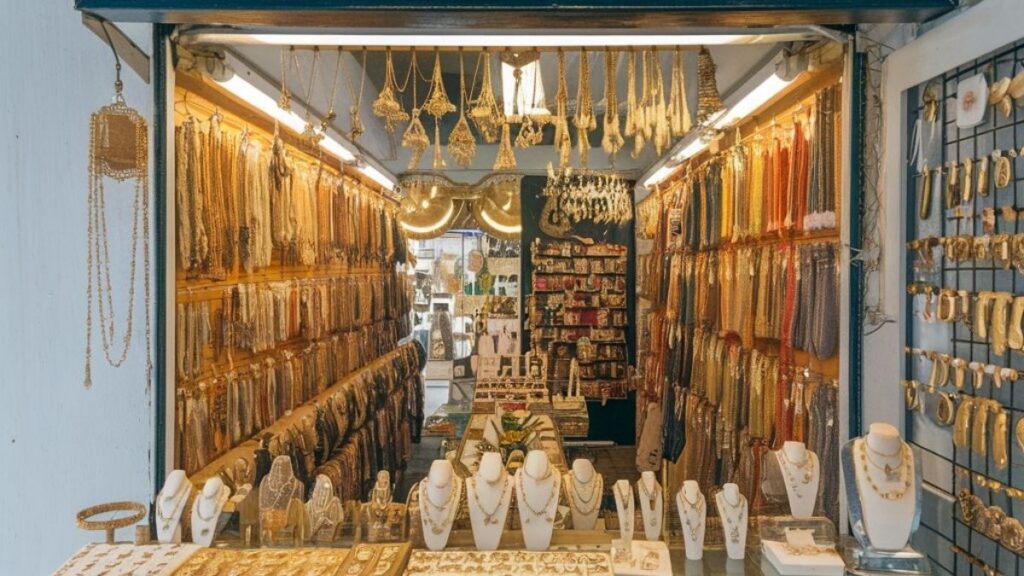

Where to Buy Gold in Abu Dhabi?

Take the following reliable sources into account if you plan to purchase gold.

- Gold Souk Abu Dhabi – Offers competitive rates and a wide variety of jewelry and bullion.

- Reputable Jewelers – Brands under Malabar Gold & Diamonds and Joyalukkas together with Damas provide customers with high-quality and legitimate jewelry products.

- Banks & Investment Platforms – Along with other platforms provide suitable options for purchasing gold ETFs and bars.

Conclusion: Stay Informed, Make Smart Decisions

Various worldwide and domestic elements cause Gold prices to experience daily changes in Abu Dhabi markets. Your decision quality will improve by knowing both per gram and tola rate movements when you buy gold for personal or investment purposes. Properly understanding market trends together with exchange rates along with demand patterns enables you to make effective gold investments.